How to write a corporate credit card policy (with template and best practices)

As more employees begin using company cards, even minor policy gaps can quickly escalate into larger issues, such as missing receipts or unclear spending guidelines. A corporate credit card policy helps close those gaps by setting clear expectations around how cards are issued, used, and monitored.

Whether you're using legacy corporate cards or modern spend management platforms, clear policies ensure everyone understands the rules. Ramp offers suggestions on creating and implementing a corporate credit card policy.

What is a corporate credit card policy?

A corporate card policy is a set of guidelines that governs employee use of company-issued credit cards. It aims to control employee spending by defining what is and isn't an authorized expense.

The goal of credit card policies is to standardize spending across the organization while protecting company funds. For finance, HR, and ops teams, this policy acts as a control system. It helps reduce policy violations, enforces accountability, and ensures faster month-end reconciliation. Without it, card programs often face inconsistent usage, lost receipts, and approval delays.

Companies without formal policies face higher risks. The Association of Certified Fraud Examiners reports that businesses lose an average of $150,000 annually to employee expense fraud, much of it linked to vague or missing card policies. A clear, well-communicated policy helps close those gaps by defining expectations upfront so your team knows how to spend and you know what to track.

Employee credit card agreements vs. corporate credit card policies

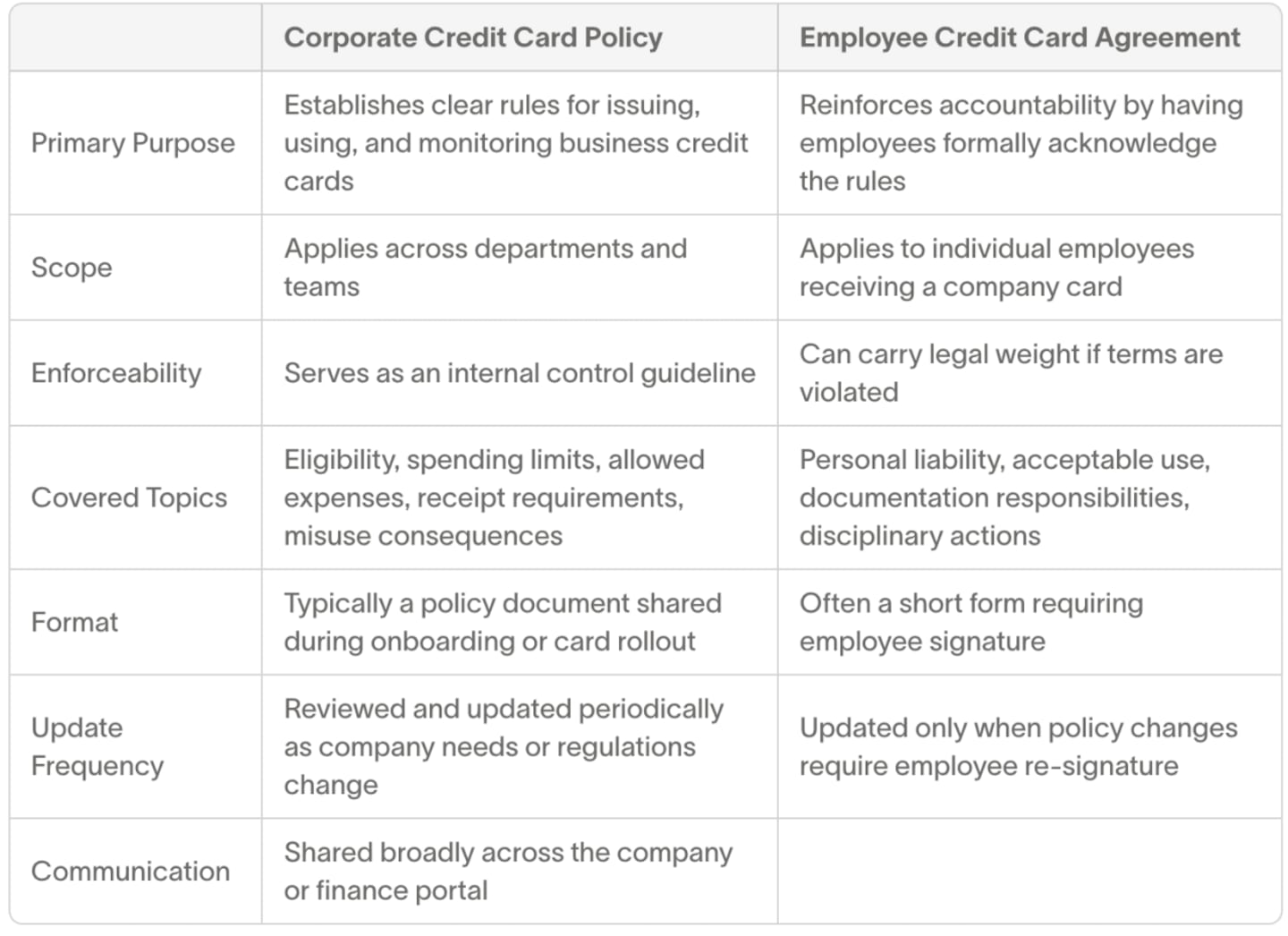

The biggest difference between a corporate credit card policy and an employee credit card agreement comes down to scope. A policy applies to your entire organization. It sets the rules for how cards should be used across teams. An agreement applies to the individual. It confirms that each employee understands those rules and agrees to follow them.

Ramp

How to create an effective corporate credit card policy

Corporate credit card policies are typically written by finance teams with input from HR, operations, and department heads. Since the policy affects how employees across the company spend, it works best when key stakeholders help shape it.

- Step 1: Define who is eligible for a card. Start by setting criteria for who can receive a company credit card. You might issue cards to managers, team leads, or employees who travel or manage vendor payments. Eligibility should reflect business needs and limit risk.

- Step 2: List approved and restricted expenses. Make it clear what employees can charge to the card. Approved expense reports might include flights, hotels, client meals, software subscriptions, or office supplies. Just as important is what's not allowed, such as alcohol, personal purchases, or cash advances. Defining these categories upfront reduces out-of-policy charges and saves time during reviews.

- Step 3: Set spending limits and category controls. Assign limits based on role, team, or project. For example, a field manager may need a higher limit than a new hire. You can also restrict spending by category.

- Step 4: Establish receipt and documentation rules. Specify when receipts are required, how they should be submitted, and what details are needed. You might require receipts for all purchases over $25 or mandate uploads within five business days. Clear documentation rules help speed up the month-end close and reduce the chance of missing or mismatched expenses.

- Step 5: Outline the approval and review process. Define how card transactions will be reviewed. Decide who approves expenses, how often reviews occur, and what happens when a charge looks suspicious.

- Step 6: Address consequences for misuse or noncompliance. Explain what happens when employees do not follow the policy. This could include written warnings, repayment of personal expenses, or card suspension. Adding this section reinforces the importance of compliance and gives managers a clear process to follow if misuse occurs.

- Step 7: Require employee agreement and onboarding. Once the policy is written, create a separate agreement for employees to sign before they receive a card. This document confirms that the cardholder understands the rules and agrees to follow them.

- Step 8: Review and update the policy regularly. Your company's needs will evolve, and so should your policy. Schedule a review every six to 12 months or whenever your team structure, vendors, or spending patterns change. Share updates with all cardholders to ensure continued clarity and compliance.

Corporate credit card policy template

You can use this template as a starting point for your policy.

[Company Name] Corporate Credit Card Policy

Effective Date: [MM/DD/YYYY]

Owner: [Finance/Operations/HR Contact Name + Email]

Last Reviewed: [MM/DD/YYYY]

Next Review Due: [MM/DD/YYYY]

1. Purpose

This policy sets the rules for how employees may use company-issued credit cards. It ensures responsible spending, reduces risk, and simplifies expense tracking across the company.

2. Eligibility

We issue cards to full-time employees who:

- Regularly incur work-related expenses

- Manage vendor or supplier payments

- Lead projects or teams with purchasing responsibilities

All card requests must be approved by the employee's department lead and reviewed by Finance.

3. Approved Expenses

Cardholders may use company cards for:

- Airfare, lodging, and local transport for business travel

- Meals during client meetings or travel

- Software subscriptions and online tools

- Office equipment or supplies

- Conference or training fees

4. Prohibited Expenses

The following are not allowed on a company card:

- Personal purchases of any kind

- Alcohol, tobacco, or recreational entertainment

- Family travel or add-on services

- Cash advances or gift cards

- Late fees or overdraft charges

Exceptions require written pre-approval from Finance.

5. Spending Limits

Card limits are assigned based on role and department.

- Default monthly limit: [$1,000 / $5,000 / custom amount]

- Department heads may request temporary increases with Finance approval

- Category-specific limits (e.g., travel, meals) may apply

- Limits are reviewed quarterly.

6. Receipt and Documentation Requirements

- Receipts must be submitted for all expenses over $25

- Receipts should be uploaded to [Expense Platform] within five business days

- Missing or unclear documentation may result in reimbursement requests or card suspension

- Receipts must include the merchant name, date, itemized amount, and payment method

7. Approval Process

- All expenses are reviewed weekly by department leads.

- Out-of-policy charges are flagged and escalated to Finance.

- Disputes or issues must be resolved within 10 business days.

8. Misuse and Violations

- First-time misuse will result in a warning and required reimbursement.

- Repeated misuse may lead to card suspension.

- Intentional misuse or fraud will result in disciplinary action, including possible termination.

9. Cardholder Agreement

Each cardholder must sign a separate agreement confirming:

- Understanding of this policy

- Commitment to following usage rules

- Responsibility for accurate documentation

10. Policy Management

This policy is maintained by [Finance/Operations].

- We conduct reviews every six months.

- We share updates via [internal portal/email].

- Questions may be directed to [policy owner email].

Acknowledgment

I have read and understood the [company name] Corporate Credit Card Policy. I agree to follow all guidelines stated above.

Employee name: __________________________

Signature: _______________________________

Date: ___________________

Best practices for corporate credit card policies

These practices help you create policies that employees actually follow while giving you the control you need—whether you're enforcing them manually or through automated systems.

Get input from finance, HR, and department managers. The most effective policies reflect how different teams actually operate. Finance understands the risks, HR knows employee expectations, and department leads know what types of spending are common. Involving all three early in the process helps you avoid unrealistic limits or missed edge cases.

Use clear, direct language to reduce confusion. Policies written with complex or legalistic language often create more questions than answers. Keep your tone consistent and easy to understand, especially when listing rules. For example, instead of writing, "Discretionary personal expenditures are prohibited," say, "Employees cannot use the card for personal purchases such as groceries, clothing, or entertainment."

Be specific about allowed and restricted expenses. Avoid broad terms like "business-related." Instead, list categories of expenses that are considered acceptable. Also, state what is not allowed, such as gift cards, alcohol, or personal travel. When employees know exactly what they can charge, they are less likely to make errors.

Match the policy to your internal workflows. Your policy should reflect how your business actually handles approvals, tracking, and reconciliation. For example, if most receipts are submitted digitally, clarify the acceptable file types and upload deadlines. If your team uses department-specific budgets, structure approval rules accordingly.

Set per-user spending limits and category controls. Assigning spend limits by user role or project helps you manage risk without micromanaging every transaction. You can also block high-risk categories at the card level. This gives you real-time oversight while reducing manual work.

Include clear rules for receipt submission and documentation. State when a receipt is required, what details it must include, and how it should be submitted. You should also define a timeline, such as requiring uploads within five business days.

Add consequences for policy violations. Employees are more likely to follow the rules when they understand the consequences. Your policy should outline what happens in cases of misuse, whether that means personal reimbursement or a formal warning. Keep this section firm but fair.

Traditional vs. automated policy enforcement

The biggest challenge with corporate credit card policies isn't writing them—it's enforcing them consistently. Traditional corporate cards require manual oversight, creating work for finance teams and delays in catching violations.

Traditional card enforcement challenges:

- Manual review of every transaction

- Chasing employees for missing receipts

- Discovering policy violations weeks after they occur

- Time-consuming month-end reconciliation

- Limited real-time visibility into spending

Why strong card policies matter and how to enforce them

A well-designed corporate credit card policy helps your business scale responsibly. When expectations are clearly documented and easy to follow, you reduce policy violations and speed up reconciliation. As your team grows and card usage expands, the right policy saves finance time, improves accountability across departments, and protects your bottom line.

The key difference lies in enforcement. Traditional cards require you to monitor compliance manually, often discovering violations weeks later. Modern platforms turn your policy into automated guardrails that prevent problems before they occur, providing real-time visibility into all spending activity.

Whether you choose traditional cards with manual oversight or automated enforcement, having a clear policy is the foundation. The difference is whether you're constantly reacting to policy violations or preventing them entirely with real-time visibility and control.

This story was produced by Ramp and reviewed and distributed by Stacker.